Password reset email sent. Please check your email inbox or spam folders. If you have not received an email, please get in contact with us.

Password reset success. Click here to Login.

Does your business have so many fixed assets it's hard to keep track of their value? That might mean you're not making the most of their value or managing them in the most efficient way.

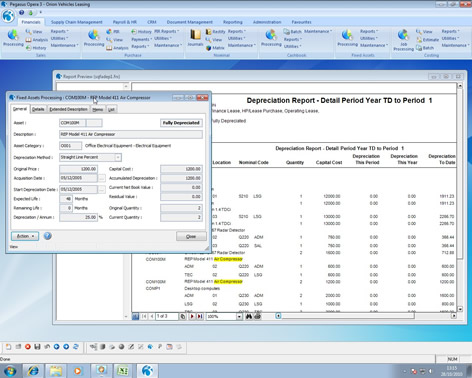

Fixed Assets in Opera 3 maintains a complete register of your company’s assets from initial acquisition through to disposal. This helps you keep control of the resources your company has invested in, avoid misappropriation, and manage them efficiently.

"Moving to Opera 3 was the best thing Foregale has ever done and without it we’d be unable to operate successfully. Opera 3 is simple, clean and intuitive which makes it easy to gather crucial business information in a timely manner. Thanks to Opera 3, Foregale can operate as an efficient and streamlined business, well placed to ride out the economic storms both now and in the future.”

"Moving to Opera 3 was the best thing Foregale has ever done and without it we’d be unable to operate successfully. Opera 3 is simple, clean and intuitive which makes it easy to gather crucial business information in a timely manner. Thanks to Opera 3, Foregale can operate as an efficient and streamlined business, well placed to ride out the economic storms both now and in the future.”

Tim Scott, Foregale Ltd

It caters for all types of assets, including:

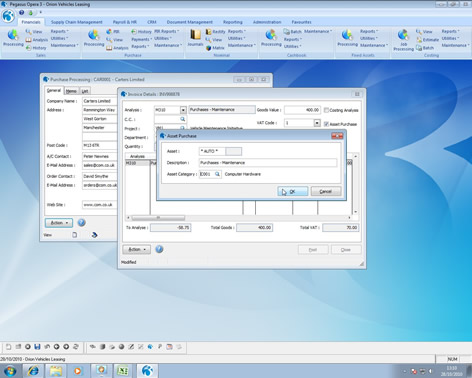

Fixed Assets calculates and records depreciation for the life of the asset, and can be linked to the Opera 3 Nominal Ledger for automatic depreciation journal postings. Opening balances and depreciation to date can be recorded for assets acquired in previous periods or years. It is easy to create asset records, using Category Groups and Asset Categories, and, when linked to the Opera 3 Purchase Ledger or PIR/POP modules, supplier invoice lines can also create Assets.